Investors often find themselves swimming in the deep end when it comes to evaluating potential stocks for their portfolio. One such category that requires fine attention to detail is dividend stocks. These stocks are particularly alluring to those craving steady income in addition to the potential for equity appreciation. Analyzing dividend stocks involves studying various key metrics which provide indicators of a company’s ability to maintain, or even increase, their dividend payouts.

To make informed investment decisions, understanding these dividend stock ratios becomes essential. These metrics allow astute investors to foresee future dividends prediction. Factors influencing these ratios span debt load, cash flow, earnings, strategic plans, capital needs, previous dividend payouts, and dividend policies. The go-to metrics amongst these are the dividend payout ratio, dividend coverage ratio, free cash flow to equity, and Net Debt to EBITDA. Understanding these metrics is fundamental to discerning the company’s financial health and likelihood of future dividend payouts.

To symbolize the importance of these vital metrics, consider the image below:

Key Takeaways

- Investors look for dividend stocks to generate consistent income and potential equity growth.

- Analyzing dividend stock ratios is crucial for making informed investment decisions.

- Key metrics to consider include the dividend payout ratio, dividend coverage ratio, free cash flow to equity, and Net Debt to EBITDA.

- These metrics shed light on a company’s financial stability and ability to maintain or increase dividends.

- Investors need to gauge future dividends prediction by studying these key metrics.

- Each valuation is influenced by factors like debt load, cash flow, earnings, strategic plans, capital needs, historical dividend payouts, and dividend policies.

Introduction to Dividend Investing

At the heart of long-term investing lies a strategy that seeks to harness the steady income stream of dividends – this is known as dividend investing. Unlike other strategies, dividend investing is less concerned with capitalizing on everyday change but concentrates on reaping steady rewards from the equities market over time.

Critical to steering this strategy are a few key concepts that make dividend investing a lucrative choice for some investors; the dividend yield and the total return.

Dividend yield is a financial ratio that indicates how much a company pays in dividends each year relative to its stock price. Earning a high dividend yield is attractive to investors looking to generate income from their investment.

However, focusing solely on dividend yield can overlook the importance of total returns, which encompass not only dividends received but also capital gains. In other words, total return accounts for both the return made on dividends and the return seen from an increase in the value of the stock.

- Dividend Yield: This ratio compares the annual dividend payment of a company to its current share price, expressed as a percentage.

- Total Return: This calculation includes both the dividend yield and the capital gains yield over a specific period, usually a year. The sum of these two components gives a holistic depiction of the performance of the stock as an investment.

Dividend investing is an approach that works harmoniously with the waves of the market, turning the volatility of the equities market to an advantage by consistently generating dividend returns. For those who invest with a long-term perspective, this method provides a reliable path to building a secure income stream over time.

With a thoughtful and pointed conception of the nuances of dividend yield and total return, dividend investing can indeed be the cornerstone for sustainable and strategic long-term investing.

Defining Dividend Stock Ratios

Understanding dividend stock ratios is paramount when predicting future dividend payments and deciphering a company’s financial health. These vital metrics, such as the dividend payout ratio and dividend coverage ratio, serve as gauges that indicate a company’s sustainability regarding dividend distribution. This section delves into the specifics of some crucial dividend stock ratios.

Importance of Ratios for Future Dividends Prediction

The key to anticipating future dividends lies in evaluating pertinent dividend stock ratios. When these ratios are accurately interpreted, they provide a snapshot of a company’s dividend policy and potential future scenarios. Notably, they reveal what portion of a company’s earnings or free cash flow is allocated towards dividends, offering insight into the sustainability of these payments.

The dividend payout ratio, for example, elucidates the fraction of earnings paid out as dividends to shareholders. A low dividend payout ratio is generally an encouraging sign, hinting at a promising growth potential for both earnings and dividends. Conversely, a high ratio could signal upcoming difficulties in maintaining dividend payments.

Types of Dividend Ratios Explained

Beyond the dividend payout ratio, several other dividend stock ratios deserve investor attention. The dividend coverage ratio and cash flow, in particular, provide additional insights into a company’s financial stability.

The dividend coverage ratio, for instance, pinpoints a company’s ability to cover dividend payments using its after-tax profit. A higher dividend coverage ratio often signifies a firm’s greater capacity to uphold its dividends.

Furthermore, free cash flow is an integral part of the equation as it computes the surplus cash after all expenses and obligations have been met. A sufficient amount of free cash flow suggests room for potential dividend payments, thereby underscoring the company’s ability to sustain them.

| Dividend Ratio | Definition | Indicates |

|---|---|---|

| Dividend Payout Ratio | The percentage of earnings distributed as dividends to shareholders | Sustainability of current dividend payments |

| Dividend Coverage Ratio | Number of times a company can pay dividends from its earnings | Company’s ability to meet dividend obligations |

| Dividend Growth Rate | The annualized percentage rate of growth of a company’s dividend payments | Attractiveness of the company to income-focused investors |

Decoding these ratios correctly is a vital step towards accurate prediction of future dividends and informed investment decisions. Hence, it is crucial to devote time and effort to comprehend the intricacies of dividend stock ratios and apply them intelligently.

The Significance of Dividend Yield

For every income investor, the dividend yield holds significant relevance. Often compared to the U.S. Treasury yield, this pivotal metric underlines the relative attractiveness of a stock’s dividend. High-yielding stock attracts attention, but it’s the parameters behind these that require astute analysis.

Comparison with U.S. Treasury Yields

In investment circles, a yield that surpasses U.S. 10-year Treasury yield is generally recognized to be high-yield. For perspective, as of June 2020, any dividend yield greater than 0.91% would be considered to exceed the Treasury yield, and hence, deemed enticing by income investors. This sets a context for approaching high-yielding stock.

High Dividend Yields and Sustainability

While high yields are invariably tempting, conscientious investors invest additional diligence to ensure dividend sustainability. A lofty yield might be a temporary advantage, but unsustainability could signal a deteriorating business health or an untenable payment structure.

High dividend yield does not always equate to a solid investment. It requires careful evaluation of dividend sustainability to avoid unseen pitfalls.

- Company History: Analyze the company’s financial performance and dividend distribution over the past few years.

- Industry Comparison: Compare the company’s dividend yield with the average yield of the industry to ensure it’s not an aberration.

- Sustainability Analysis: The company’s earnings, payout ratio, and debt load can provide further insights into the sustainability of the dividend.

The above measures can provide a comprehensive evaluation of a high-yielding stock, forming a solid base for investors to make informed decisions.

Dividend Payout Ratio as a Stability Indicator

Grasping the dividends of a company is a vital component of forecasting a firm’s financial growth and stability. Particularly, the dividend payout ratio supplies valuable insights into an organization’s dividend policy and its ability to maintain or increase dividends. Calculated by comparing earnings per share to cash dividends, this ratio serves as a compass for investors navigating the dividend landscape.

Interpreting Payout Ratios

A dividend payout ratio less than 50%, signifies a stable company with growth potential in earnings and dividends. It is considered healthy as it allows a company plenty of wiggle room to absorb financial setbacks and still maintain its dividend payments. By contrast, a payout ratio exceeding 50% may be an alert signal. It highlights limited room for dividend growth and possible challenges in maintaining payouts, despite possibly indicating an attractive current yield. Companies can endure high payout ratios only as long as they maintain stable earnings.

Comparing Ratios Within Industries

When analyzing dividend payout ratios, it’s ideal to avoid considering them in isolation. Instead, compare them against industry averages or equivalent competitors—even better if they are direct competitors. Comparisons offer a realistic benchmark, enabling investors to perform a more nuanced analysis of a company’s dividend stability. Consequently, it aids in making sound decisions based on a company’s relative standing within its industry.

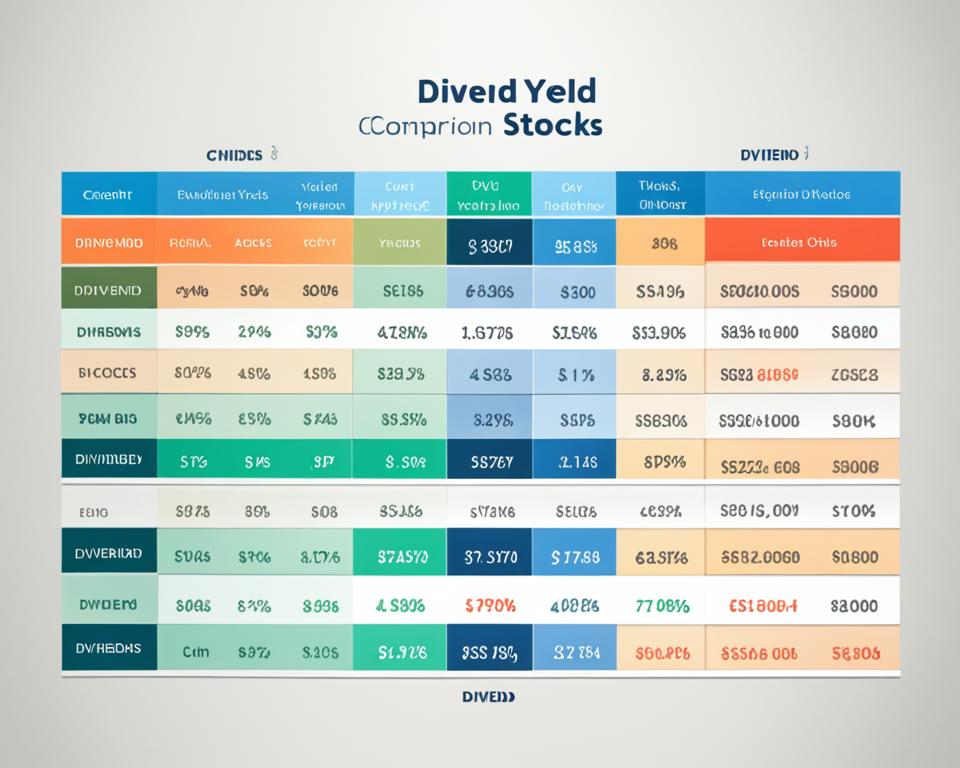

Let’s examine an illustrative example of such a comparison:

| Company | Dividend Payout Ratio | Industry Average |

|---|---|---|

| Company A | 45% | 50% |

| Company B | 70% | 50% |

In this simplified scenario, Company A, with a dividend payout ratio marginally lower than the industry average, may likely be in a better position to expand dividends or maintain the same level of dividends in case of any earnings slump. On the other hand, Company B, despite its potentially attractive yield, has a higher payout ratio than the industry average, suggesting potential difficulties in maintaining dividends if there is an unexpected downturn.

In conclusion, understanding dividend ratios, especially the dividend payout ratio, and comparing them within industries can guide investors towards making well-informed decisions about a company’s dividend stability.

Evaluating Dividend Coverage Ratio

The dividend coverage ratio is an exceptional financial metric that delivers insights into a company’s capability to meet its dividend obligations from net income across a specific fiscal period. When investors focus on the ability of a company to sustain its dividends, this ratio plays a critical role in their assessments. The higher the ratio, the more it signifies the company’s capacity to maintain or potentially increase dividends. This augments its appeal to current common shareholders and potential investors.

Oftentimes, the calculation of a dividend coverage ratio involves taking a company’s total annual earnings per share (EPS) and dividing that by the dividends per share (DPS). This can illustrate numerically how many times a firm can amply compensate its dividends from net earnings of a given year.

Alternatively, the ratio can be computed by considering a company’s entire net income and dividing it by the total dividends designated to common shareholders. Both variations are valid and provide beneficial insights, but the latter provides a more collective representation. It encompasses all common shareholders rather than only analyzing an earnings to per-share perspective.

Below is an orderly interpretation of various ranges of the dividend coverage ratio:

- An extremely high ratio suggests that the firm can comfortably meet its current dividend payments because the company’s earnings far surpass the dividends.

- A ratio around 1 reveals that the company’s net earnings are nearly equal to the dividends it must pay, signifying potential financial distress in case of any shrinking of profits or unanticipated downturn.

- If the ratio is less than 1, it indicates that the company is essentially not earning sufficient net income to cover its dividends. This could echo an impulsive decision to gain short-term attractiveness to shareholders at the expense of long-term financial stability.

Therefore, it’s essential for investors to employ the dividend coverage ratio in conjunction with other essential financial ratios to obtain a comprehensive view and make well-informed decisions on whether to invest in a particular company’s stocks.

Each company has its unique financial context and industry, thus being interpretative and cautious with the ratios and acknowledging the bigger picture is necessary for a strategic assessment and comparison.

The Role of Free Cash Flow to Equity (FCFE)

Every investor appreciates the key role that Free Cash Flow to Equity (FCFE) plays when evaluating a firm’s viability in sustaining its dividend payments. This powerful performance metric provides a credible basis for assessing a company’s financial health, giving investors a deeper insight into the plausibility of cash distributions to shareholders.

FCFE and Dividend Viability

FCFE essentially measures the remaining cash available to shareholders after taking into account elements such as capital expenditures, net working capital, and all existing debt payments. A positive and healthy FCFE is suggestive of the firm’s ability to comfortably cover its dividend payouts, eliminating fears of financial strain or potential default. Importantly, the greater the FCFE ratio, the higher the likelihood of dividend viability, thus commanding the trust of investors.

Calculation and Interpretation of FCFE

FCFE = Net Income + Non-Cash Charges + Interest Expense x (1 – Tax Rate) – Capital Expenditures – Changes in Net Working Capital

This formula may seem complex, but in reality, it depicts the firm’s efficiency in generating cash flow while taking into account tax obligations, capital investments needed to maintain growth, and changes in working capital. High FCFE showcases a business with sound financial management, effectively juggling these multiple factors to leave ample cash for distributions to shareholders.

Understanding FCFE becomes indispensable when trying to estimate a company’s potential to maintain or raise dividends over time. A declining or negative FCFE ratio could potentially signal looming financial issues which may jeopardize the sustainability of dividends—a red flag for any income investor.

Analyzing Net Debt to EBITDA Ratio

Understanding the potential risks and financial health of a company, especially when it comes to dividend payments, often involves a deeper look into key financial metrics. One such crucial metric is the Net Debt to EBITDA ratio. This ratio is a valuable tool for examining a company’s risk related to debt leverage.

Investors generally favor a lower Net Debt to EBITDA ratio because it signifies a solid debt position in relation to earnings. It reflects a company’s capacity to meet its dividend obligations with its earnings before interest, taxes, depreciation, and amortization (EBITDA).

On the contrary, a high and rising Net Debt to EBITDA ratio could be a danger signal. It implies high levels of financial leverage and the potential risk of cash flow shortages.

Such a situation can influence a company’s ability to fulfill its dividend obligations. It could even lead to a cut in dividend payments, which is a considerable disadvantage for dividend-focused investors.

| Net Debt to EBITDA Ratio | Description |

|---|---|

| Less than 3 | Generates sufficient EBITDA to cover its debt obligations |

| 3 to 4 | Faces potential difficulties in covering its debt obligations with EBITDA |

| Greater than 4 | Has significant amounts of debt compared to EBITDA; faces serious risk of default |

To conclude, the Net Debt to EBITDA ratio is an essential tool for investors looking to scrutinize a company’s capacity and sustainability in handling its debt and fulfilling its regular dividend payments. A high ratio may flag a company at risk for dividend cuts or even a collapse in stock price due to high debt levels.

Special Considerations for Dividend Ratios

There is no single financial ratio capable of compassing the full magnitude of understanding required to predict a company’s ability to continue its dividend payments. Income investors must adopt an investigative approach to navigate the special considerations that are unique to dividend stocks.

A comprehensive understanding of a company’s reliability in sustaining its dividends can only be achieved by considering the collective insights provided by a combination of ratios. Examining the payout rates, coverage ratios, and leverage metrics such as the Net Debt to EBITDA ratio can provide a more well-rounded analysis.

Expected dividend cuts can be forecasted by watching for certain trends. Crucial indicators include a high payout ratio close to or exceeding 100%, a low or declining coverage ratio, and a high and escalating Net Debt to EBITDA ratio.

Analyzing a single metric in isolation won’t provide a reliable indication of a company’s financial health or its ability to maintain dividend payments. Rather, these metrics should be used in conjunction, each one contributing a piece to the overall puzzle.

Below is a table providing guidance on the interpretation of these key financial ratios:

| Ratio | Healthy Range | Warning Signs |

|---|---|---|

| Dividend Payout Ratio | 20-50% | Greater than 100% |

| Dividend Coverage Ratio | Greater than 2x | Less than 1x |

| Net Debt to EBITDA Ratio | Less than 3x | Greater than 5x |

Remember: context is king. These ratios and their interpretations don’t exist in a vacuum. They must be considered in light of a myriad of factors and within the context of industry norms.

In conclusion, gaining a thorough understanding of the different dividend ratios and how they can be used in concert to provide holistic analysis is a must for any serious income investor.

Dividend Growth Rate and Historical Performance

The importance of dividend growth rate in assessing a company’s future dividends cannot be overstated. This vital metric offers insight into a company’s trend of progressively increasing dividend payments. Consistent dividend growth often signifies the reliability of a firm, as it reflects a dedication to enhancing shareholder value. Thus, investors regularly monitor the dividend streak, which represents the extent of uninterrupted years that a company has either maintained or elevated its dividend, to gauge its financial stability.

Understanding Dividend Growth Over Time

Interestingly, the dividend growth rate provides a historical account of how a company has managed its dividends over time. The longer a company has been able to sustain or increase its dividends, the greater its financial stability appears. This operational resilience, in conjunction with a long history of dividend increase, signals a corporation’s likelihood to continue dividend payments in the future. Therefore, the dividend streak serves as a reassurance to investors seeking income reliability from their investments.

Identifying Reliable Dividend Contenders

There are distinct categories of stocks that warrant special investigation due to their enduring commitment to dividend growth. Such classifications include the esteemed Dividend Aristocrats and Dividend Kings. These select groups of companies are defined by their unwavering history of consistently raising dividends over a remarkably lengthy period. As such, these firms represent a strong track record of financial stability and income reliability. For investors prioritizing dividend payouts, these Dividend Aristocrats and Kings offer a trustworthy approach towards securing a steady flow of dividend income.

FAQ

What are the key metrics to consider when analyzing dividend stocks?

When analyzing dividend stocks, it’s essential to consider key metrics including dividend stock ratios, dividend payout ratio, dividend coverage ratio, Free Cash Flow to Equity (FCFE), and Net Debt to EBITDA. These metrics help predict future dividends and provide insights into a company’s financial stability and dividend policies.

What is Dividend Investing?

Dividend investing is a strategy that focuses on generating a steady income through dividend payouts while also benefiting from capital growth. This investment approach is mainly suitable for long-term investors seeking to mitigate market volatility while enjoying a consistent income stream.

How are Dividend Stock Ratios defined and their importance?

Dividend stock ratios like the payout ratio and the coverage ratio are key metrics that indicate how much of its profits a company returns to shareholders as dividends and its capacity to cover these payments, respectively. These ratios are crucial for predicting future dividend payments and assessing a company’s health and dividend distribution policy.

What is the significance of Dividend Yield?

Dividend yield is a crucial metric that provides an indicator of a stock’s dividend attractiveness. A yield surpassing the U.S. 10-year Treasury yield is typically regarded as high yield. However, while high yields may be enticing, their sustainability should be assessed to ensure that they do not represent an unsustainable payment structure.

How do you interpret the Dividend Payout Ratio?

The dividend payout ratio, which compares annual dividends to earnings per share, serves as an indicator of dividend stability. A payout ratio of less than 50% suggests a reliable company with growth potential in earnings and dividends, while a payout ratio exceeding 50% signifies potential difficulties in maintaining payouts.

How is the Dividend Coverage Ratio evaluated?

The dividend coverage ratio measures a company’s ability to pay dividends from its net income in a given fiscal period. A higher coverage ratio implies a more favorable outlook, indicating a stronger ability to sustain and potentially increase dividends.

What role does Free Cash Flow to Equity (FCFE) play in dividends?

FCFE quantifies the remaining cash available for dividends after accommodating all debts, expenses, and necessary reinvestments. A positive FCFE indicates a company’s ability to cover its dividend payments without financial strain.

What does the Net Debt to EBITDA Ratio indicate?

The Net Debt to EBITDA ratio is key for decoding a company’s debt-related risk, particularly in relation to the sustainability of dividend payments. A lower ratio indicates a stable debt position, while a high ratio signals potential cuts in dividend payments and indicates high financial leverage.

What special considerations should be given to Dividend Ratios?

No single financial ratio can wholly account for a company’s capacity to continue its dividend payments. Income investors should consider the collective message conveyed by different ratios to navigate dividend stocks’ unique considerations. This allows for a comprehensive understanding of a company’s ability and reliability in sustaining its dividends.

How does the Dividend Growth Rate reflect historical performance?

The dividend growth rate is an important metric that demonstrates a company’s trend of increasing dividend payments over time. Companies with consistent dividend growth, such as Dividend Aristocrats or Dividend Kings, are typically deemed reliable as they demonstrate a commitment to returning value to shareholders.